Visitor Loyalty Will Make or Break Paid Content Plans: A Look at Optimal Pricing

Despite all the recent talk and speculation over whether content web sites should adopt a pay for access model, surprisingly little attention has been paid to the underlying economic theories behind any such move. Few new papers on the economics of digital information goods have been published since the late ’90s.

Many of those papers remain surprisingly relevant today and anyone interested in the field would do well to go back and read them. I’ve been doing just that recently in preparation for my senior economics thesis.

One particularly good paper was written in 1999 by John Chung-I Chuang and Marvin A. Sirbu, two professors of Engineering and Public Policy. The paper, “Optimal Bundling Strategy for Digital Information Goods: Network Delivery of Articles and Subscriptions”, provides many interesting insights into recent discussions of the topic. In it, the authors come up with an optimal pricing model for access to academic journals online. Their method applies just as easily to news articles and websites.

Results

The first conclusion of the paper is that the optimal strategy is always to offer both site wide subscriptions AND a micropayments plan for sales of individual articles. This pricing strategy will (with reasonable assumptions) always be more profitable than solely offering one or the other.

A second indirect point is that visitor loyalty will determine not only how many visitors can be converted into paying visitors, but also what proportion of revenue will come from subscriptions versus individual sales. The more loyal visitors are, the greater the fraction of revenue that will come from subscriptions.

Sidenote: This paper assumes that the publisher is acting as a monopolist. The publisher’s offerings must be sufficiently differentiated from competitor’s products that consumers will not switch, and any switching that does occur is not taken into account. If switching does occur, then the assumption is that a competitor offers a similar mix of products. Thus, the proportion of subscription versus individual sales revenue does not change.

Theory

The theoretical underpinnings of this paper are in bundling theory. In bundling, we examine the problem of a publisher offering multiple goods (articles). A consumer places some value on each article. If the price of the article is below the value they place on it then they will purchase it. Likewise, for some bundle of articles, if the value the consumer places on the sum of their individual valuations is less than the price of the bundle, they will purchase it.

Over a subscription period where a publisher produces N-articles, then there are 2^N different sub-bundles to sell. These sub-bundles could include content grouped by category, author or any other distinguishing feature. However, it is extremely computationally difficult as N gets large. To simplify things, only the entire bundle, and sales of individual articles are considered.

Customer Preferences

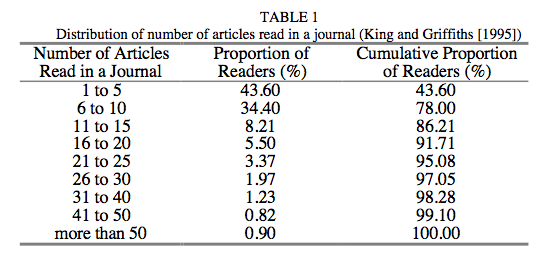

In addition to these two conclusions, the paper also illustrates how little hard data is available in this field with which to do research. Their model describes the preferences of consumers as a distribution on two factors. Willingness-to-pay and percentage of articles valued. Their willingness-to-pay for their most valued article and the percentage of articles with non-zero value. Without hard data on the actual value readers place on articles in journals or on news websites, the study assumes a uniform distribution. Data on percentage of articles with non-zero value comes from a study by researchers King and Griffiths showing the distribution of the number of articles read in a Journal.

A good analogue to this survey data for content websites would be to use traffic data on visitor loyalty. How many pageviews per unique visitor does a site have? What’s the distribution of this statistic? Nielsen Online has begun to put together a new statistic for newspaper websites, session per user per month.

Pricing Strategy

Based on the data for academic journal readers, the authors calculate that the optimal price for a subscription should be approximately 10 times greater than that of an individual article. With this pricing strategy, the content producer’s revenue stream is well balanced with 56% from sale of individual articles and 44% from that of subscriptions.

Some publishers have started to speculate that their best hope of monetization may be with their most loyal visitors and not with ever higher traffic numbers. Still, much is up in the air.

A recent BCG survey begins the task of gathering the necessary data to make intelligent decisions about whether or not to charge for news. Still plenty more to do though.

More Data Needed

To apply a model similar to Chuang and Sirbu’s to news websites two datasets are required. One, is the survey or experimental data needed to find the distribution of consumers’ willingness-to-pay for a specific article. The other is a data set on visitor loyalty. If anyone knows of an existing data set for either of these, please let me know. I’m also in the process of gathering these data sets. If you want to share analytics from your news website to help my research, please let me know too.

I’ll be summarizing a few more of the papers and studies in the field and looking at other theoretical pricing models for digital content.